Investors don’t just want vision; they want numbers to back it up. A robust financial model instills clarity to plan, inspiration to pitch, and credence to raise capital. However, coming up with one from scratch, especially in the chaotic early stages of setup, is a significant task.

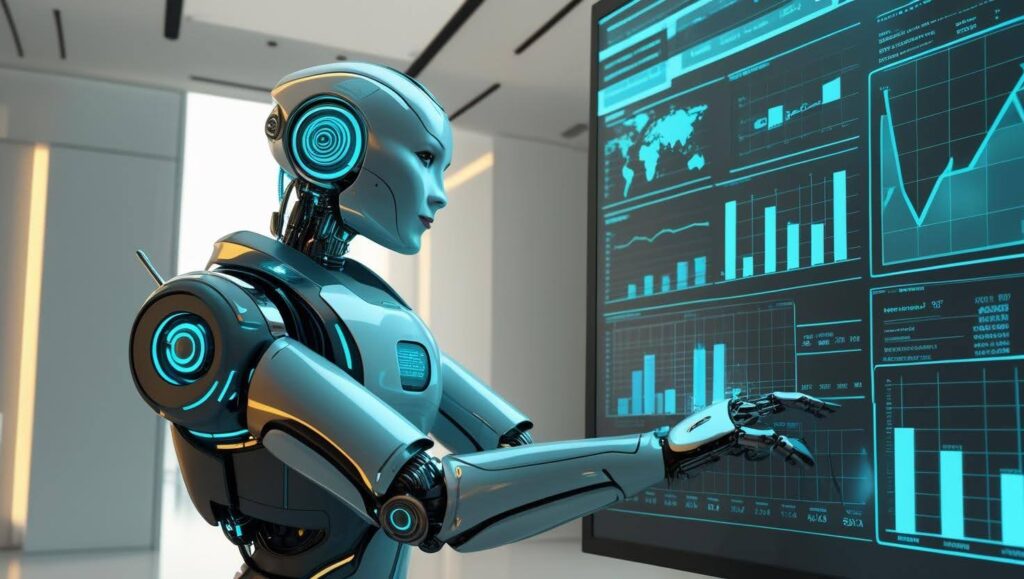

Companies, especially startups, are therefore rapidly shifting away from traditional and spreadsheet-heavy forecasting techniques toward newer AI-based financial modeling platforms. These AI-powered platforms eliminate the drudgery of data gathering, which requires manual entry, error checking, and scenario building. This shift isn’t just about convenience; it has become essential for fundraising, strategic planning, and investor trust.

What is financial modeling, and why does it matter

At its essence, financial modeling entails the development of mathematical representations of your company’s financial activity, using past data, market surveys, and assumptions about the future.

Think of financial modeling as a blueprint of your company’s financial future. It is higher than mere numerical calculations in a spreadsheet. It is creating and automating a mathematical narrative that explains how the startup will generate revenue, spend money, and eventually exist as a financially viable concern.

But what really makes it matter? An automated model is not the one that simply predicts the future; it is one that helps you shape it. Every assumption you make, every scenario you test, and every projection you create becomes a roadmap for decision-making.

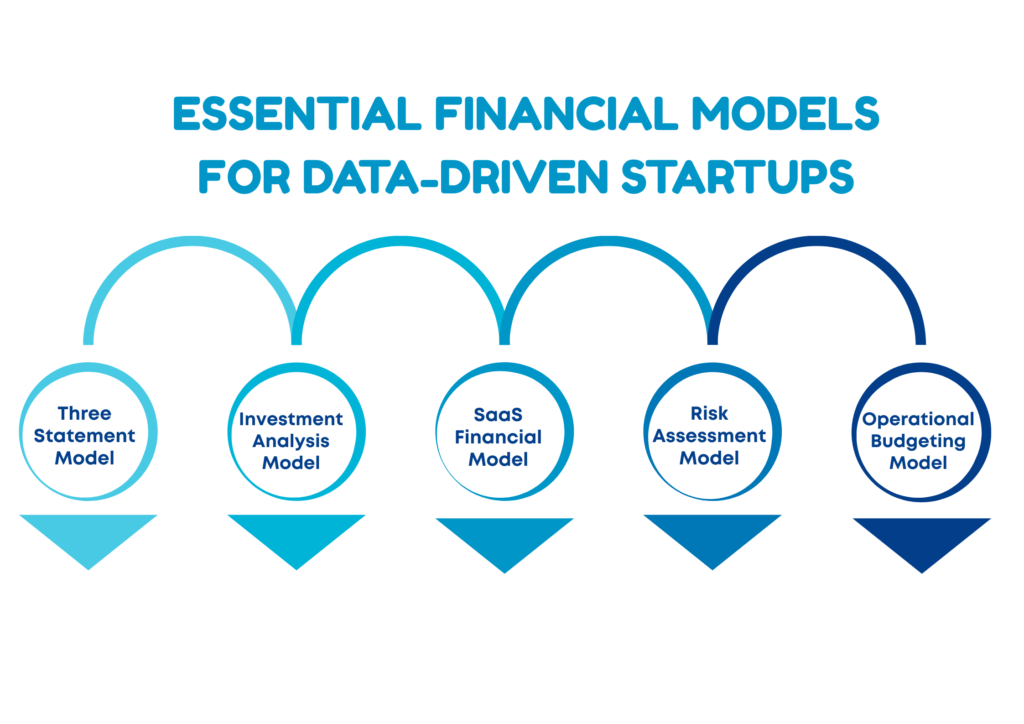

Choosing the right financial fit for your startup

Traditional financial models often rely on assumptions pulled from thin air or outdated industry reports. Modern investors, equipped with sophisticated analytics tools, can quickly spot unrealistic projections. These AI-based financial extraction tools supply a whole lot of financial indicators-price quotes, earnings reports, and economic forecasts. That helps you base your forecast on the reality of the market, as contrasted with wishful thinking.

When you choose the right financial fit powered by real-time financial data extraction, you’re not just presenting numbers; you’re demonstrating the analytical rigor that successful startups require.

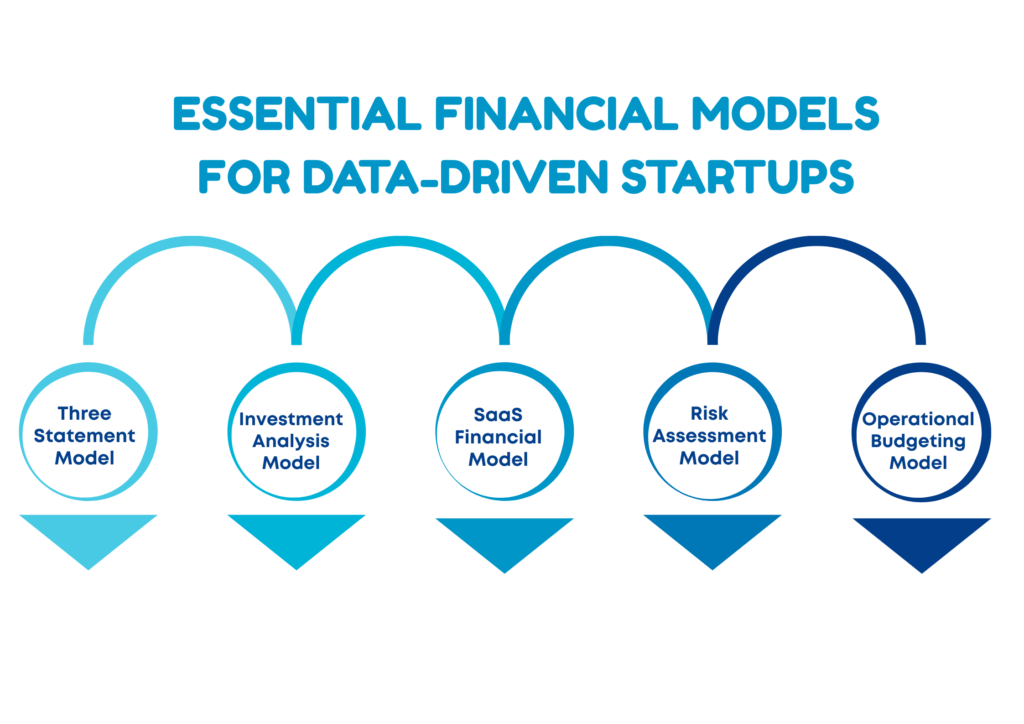

Three-statement model

- Integrates income statement, balance sheet, and cash flow using real-time financial data extraction

- Provides a comprehensive view of your startup’s financial health by connecting all major financial statements. This allows you to see how revenue changes impact cash flow and overall financial position in real-time.

Investment analysis model

- Leverages market data and economic forecasts to assess funding opportunities and valuation scenarios

- Helps startups make informed decisions about raising capital by analyzing market conditions, comparable company valuations, and economic indicators to determine optimal timing and valuation expectations.

SaaS financial model

- Tracks subscription metrics with automated data collection for MRR, churn, and customer analytics

- Essential for subscription-based startups, this model automates the tracking of key SaaS metrics. That includes monthly recurring revenue, customer acquisition costs, and lifetime value to optimize growth strategies.

Risk assessment model

- Uses real-time market updates and macroeconomic indicators to evaluate financial risks and opportunities

- Continuously monitors external factors that could impact your startup’s performance. This helps you identify potential threats and opportunities before they significantly affect your business operations.

Operational budgeting model

- Automates financial reporting and data extraction for accurate monthly/quarterly planning and resource allocation

- Streamlines day-to-day financial management by automatically pulling data from various sources. This enables precise budget tracking and helps founders make quick, informed decisions about spending and resource allocation.

How to build investor-ready forecasts using financial modeling: a step-by-step approach

Staring at an empty spreadsheet, wondering where to start your financial model? You’re not alone. Most founders feel overwhelmed when facing this crucial task for the first time. Once you understand the core principles, building a financial model becomes surprisingly straightforward.

Let’s break down the process into manageable steps that anyone can follow with ease.

Step 1: Establish market-validated revenue foundations

Start with how your business makes money, your revenue model. Instead of just guessing market conditions, start with real-time financial intelligence. Use a financial intelligence tool to pull the important market context your revenue projections need. This includes revenue growth rates, pricing strategies, and market performance data from similar companies in your sector. Access real-time earnings reports and financial filings to understand industry dynamics affecting your revenue potential. Compare your pricing strategy against competitor data extracted from public financial documents. Use historical growth patterns from comparable companies to justify your own growth assumptions.

Step 2: Build data-driven customer and market metrics

Your customer assumptions need market validation. Automated data extraction from earnings transcripts, investor presentations, and financial filings delivers real-world customer metrics that can be used for benchmarking and competitive analysis. Create a quartile analysis to see where your assumptions fit within industry ranges. Then, refine your projections based on realistic market benchmarks and document your benchmarking methodology for investor presentations.

Step 3: Create intelligent expense scaling models

Instead of relying on assumptions or static benchmarks, tap into real-world data to guide your financial planning. Automatically extract expense ratios from 20+ comparable companies to see how your peers operate. Use these insights to build dynamic expense scaling models tied to revenue multiples, and run sensitivity analyses to understand how your costs might shift under different growth scenarios. Set up automated alerts to catch deviations from expected benchmarks early, so you can course-correct before small issues become big ones.

Step 4: Develop sophisticated cash flow projections

Revenue might be the headline, but cash is the lifeblood of any startup. Gain a sharper view of your cash position with real-world data. For cash inflows, extract payment terms, collection periods, and seasonal trends from peer filings, and model revenue timing based on industry norms. On the outflow side, analyze accounts payable patterns, capex cycles, and working capital needs using competitor data. For runway analysis, benchmark your burn rate, model funding needs, and project runway scenarios using actual growth and cash consumption metrics, all powered by automated extraction and market-validated insights.

Step 5: Generate professional financial statements

Create investor-ready financial statements backed by real-time financial intelligence. Validate income statement assumptions like revenue recognition, gross margins, and operating leverage using peer benchmarks. Enhance your balance sheet by modeling working capital, asset needs, and debt capacity based on industry ratios. Optimize the cash flow statement with accurate cash conversion cycles, capex benchmarks, and free cash flow comparisons, ensuring your projections are accurate, defensible, and aligned with market realities.

Step 6: Create investor-grade presentations

Turn your financial data into clear, compelling investment narratives with intuitive visuals and real-time insights. Financial automation tools let you generate executive dashboards, scenario comparisons, and detailed appendices with source and methodology transparency. Build interactive presentations where investors can adjust assumptions on the fly, and share benchmarking reports that validate your position in the market. With automated quarterly updates, variance analysis, and alerts for key market shifts, you stay proactive and aligned, making it easier for investors to trust your numbers and your story.

Step 7: Validate and stress-test your models

Continuous model validation is achieved by benchmarking key metrics against 50+ comparable companies, stress-testing assumptions with historical economic data, and validating market size using aggregated industry insights. Models are refined quarterly with updated data, performance comparisons, and detailed audit trails tracking assumption changes.

Turning forecasts into fundraising power

Great ideas start a startup, but strong financial models keep it going. A good model doesn’t just show where you are; it helps you see where you’re headed. When your numbers back your story, you build trust, make smart choices, and move forward with confidence.

That’s where FinX makes all the difference. It simplifies the entire financial modeling process, automating data extraction from earnings reports, filings, and investor presentations to help you build forecasts grounded in real-world market intelligence. Whether you’re validating assumptions, modeling expenses, or preparing investor-ready statements and presentations, it brings structure, speed, and accuracy to your financial strategy.

With FinX, you’re not just building a model. You’re building investor trust, faster funding rounds, and a clearer path to growth.