The use of artificial intelligence (AI) in financial markets has grown rapidly, with large language models (LLMs) increasingly applied to equity analysis, portfolio management, and stock selection. BlackRock research team proposed AlphaAgents for investment research. The AlphaAgents framework leverages the power of multi-agent systems to improve investment outcomes, reduce cognitive bias, and enhance the decision-making process in equity portfolio construction.

The Need for Multi-Agent Systems in Equity Research

Equity portfolio management traditionally relies on human analysts who synthesize vast, diverse datasets—financial statements, news reports, market indicators, and more—to make judicious stock selections. This process is susceptible to cognitive and behavioral biases, such as loss aversion and overconfidence, which are well-documented in behavioral finance literature.

LLMs can process large volumes of unstructured data rapidly, extracting actionable insights from sources like regulatory disclosures, earnings calls, and analyst ratings. However, even powerful models face challenges:

- Hallucination: Generating plausible-yet-inaccurate information.

- Limited domain focus: Singular agents may overlook contrasting perspectives or fail to consider the interplay of market sentiment, fundamental analysis, and valuation.

- Cognitive bias mitigation: Reducing human-like biases in automated decision-making.

Multi-agent LLM frameworks aim to address these pitfalls through collaborative reasoning, debate, and consensus-building.

AlphaAgents Framework: System Architecture

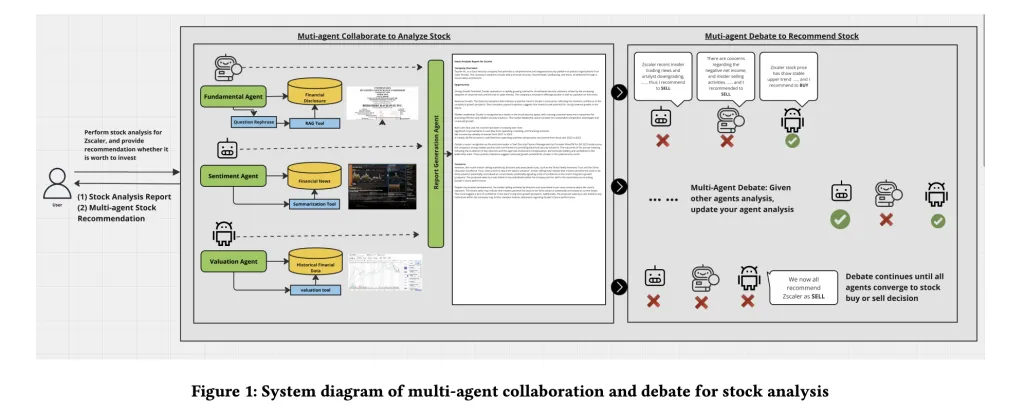

AlphaAgents is a modular framework designed for equity stock selection, featuring three core specialized agents, each representing a distinct analytical discipline:

1. Fundamental Agent

- Function: Automates qualitative and quantitative analysis of company fundamentals using 10-K/10-Q filings, sector trends, and financial statements.

- Tools: RAG (Retrieval-Augmented Generation) for report analysis, direct data extraction from filings, and domain-specific prompt engineering.

2. Sentiment Agent

- Function: Analyzes financial news, analyst ratings, executive changes, and insider trading disclosures to gauge market sentiment’s impact on stock prices.

- Tools: LLM-based summarization and reflection-enhanced prompting, driving informed recommendations and sentiment classification.

3. Valuation Agent

- Function: Evaluates historical stock prices and volumes to determine valuation, calculate annualized returns/volatility, and assess pricing trends.

- Tools: Computational analytics for volatility and return calculations, aided by mathematical tool constraints for rigor.

Each agent operates on data specifically sanctioned for their designated role, minimizing cross-domain contamination.

Role Prompting and Agent Workflow

AlphaAgents employs “role prompting,” carefully crafting agent instructions aligned with financial domain expertise. For example, the valuation agent is prompted to focus on long-term price and volume trends, whereas the sentiment agent synthesizes news-driven market reactions.

Coordination is managed by a group chat assistant (built on Microsoft AutoGen), which ensures equitable participation and consolidates agent outputs. In cases of divergent analysis or recommendation, a “multi-agent debate” mechanism (round-robin style) enables agents to share perspectives and iterate toward consensus—a process designed to reduce hallucination and enhance explainability.

Incorporating Risk Tolerance

AlphaAgents introduces agent-specific risk tolerance modeling via prompt engineering, mimicking real investor profiles—risk-neutral versus risk-averse. For instance:

- Risk-Averse Agents: Narrow stock selections, emphasizing low volatility and financial stability.

- Risk-Neutral Agents: Broader picks, balancing upside potential with measured caution.

This allows tailored portfolio construction reflective of varying investment mandates—a novel aspect not widely embedded in previous multi-agent financial systems.

Evaluation and Backtesting

1. Retrieval-Augmented Generation (RAG) Metrics

AlphaAgents leverages Arize Phoenix to evaluate the faithfulness and relevance of agent outputs, using retrieval metrics for agents relying on RAG and summarization (e.g., fundamental and sentiment agents).

2. Portfolio Back-testing

The critical downstream evaluation involves backtesting agent-driven portfolios against a benchmark over a four-month window.

Portfolios constructed include:

- Valuation agent portfolio

- Fundamental agent portfolio

- Sentiment agent portfolio (where sufficient news coverage)

- Coordinated multi-agent portfolio

Performance metrics:

- Cumulative return

- Risk-adjusted return (Sharpe Ratio)

- Rolling Sharpe ratio for dynamic risk assessment

Findings reveal:

- Risk-Neutral Scenario: Multi-agent collaboration outperforms single-agent approaches and the market benchmark, synergizing short-term sentiment/valuation and long-term fundamental perspectives.

- Risk-Averse Scenario: All agent-driven portfolios are more conservative, lagging the benchmark due to tech sector rallies and lower volatility exposures. The multi-agent approach, however, achieves lower drawdowns and better risk mitigation.

Key Insights and Practical Implications

- Multi-agent LLM frameworks bring robust, explainable reasoning to stock selection, with modularity for scaling and integration of new agent types (e.g., technical analysis, macroeconomic agents).

- The debate mechanism echoes real-world investment committee workflows, reconciling differing perspectives for transparent decision trails—a critical feature for institutional adoption.

- AlphaAgents serves not only for portfolio construction but as a modular input for advanced optimization engines (Mean-Variance, Black-Litterman), expanding use cases in modern asset management.

- Human-in-the-loop transparency: All agent discussion logs are available for review, offering override and audit capabilities critical for institutional trust.

Conclusion

AlphaAgents represents a compelling advancement in agentic portfolio management: collaborative multi-agent LLMs, modular architecture, risk-aware reasoning, and rigorous evaluation. While current scope centers on stock selection, the potential for automated, explainable, and scalable portfolio management is clear—positioning multi-agent frameworks as foundational components in future financial AI systems.

Check out the Paper. Feel free to check out our GitHub Page for Tutorials, Codes and Notebooks. Also, feel free to follow us on Twitter and don’t forget to join our 100k+ ML SubReddit and Subscribe to our Newsletter.