Running an electrical contracting business often means juggling projects, teams, and paperwork. But nothing creates more frustration than waiting to get paid. Sometimes clients take weeks to respond. Other times, the paperwork isn’t sent at all. Either way, cash flow stalls, and you end up chasing money instead of moving to the next job.

From what I’ve seen, invoicing is often treated as something to deal with later – at the end of the week or even the month. That delay creates a ripple effect: payroll tightens, materials can’t be restocked, and projects lose momentum.

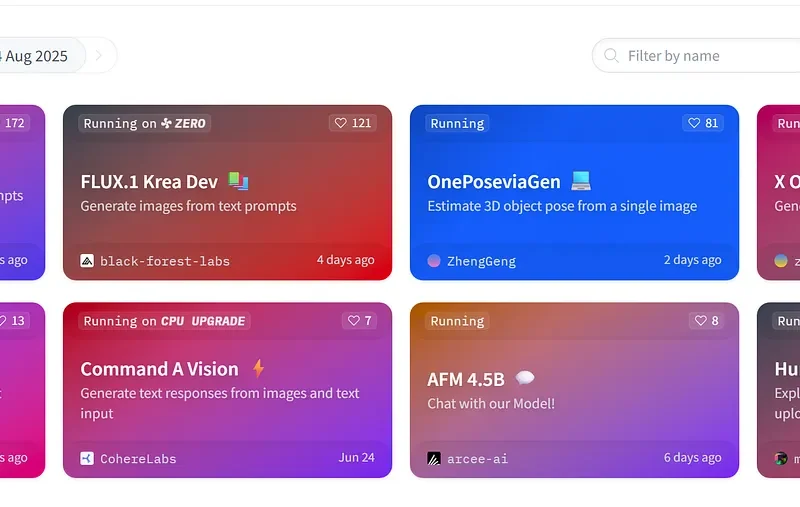

Tools built into electrical software have started changing that picture. They bring speed, accuracy, and transparency to a process that was once clunky and slow.

1. The Strain of Late Payments

Most contractors don’t have the cushion of large accounting teams or cash reserves. A delayed payment quickly shows up in wages, material orders, and scheduling.

Some common causes:

- Multiple projects generate multiple invoices that need follow-up

- Paper-based billing slows everything down

- Thin margins leave no room for delays

A recent survey of 250 U.S. contractors found that 70% faced late payments, and 10% reported delays longer than 30 days. Many said quicker, digital billing methods would help prevent the problem.

2. Moving From Job Completion to Payment Without Delay

The gap often starts when a job is done. If a technician waits until the week’s end to send the invoice, the client is less likely to pay quickly.

Automation helps close that gap:

- Immediate billing on-site – technicians can issue invoices via a mobile device as soon as the work is complete.

- Faster turnaround – reports show automated invoices cut processing time by three-quarters and reduce errors significantly.

- More efficient use of time – less manual admin means teams can focus on the actual work.

Sending a clear invoice right after the job keeps it fresh in the client’s mind, often leading to faster payment.

3. Accuracy Keeps Things Moving

A small error in an invoice missing details, wrong price, unclear notes can hold up payment for weeks. Studies suggest automation cuts manual mistakes by as much as 90%.

When invoices reflect the exact work completed, clients rarely hesitate to pay. That smooth link between job and payment makes a big difference for day-to-day operations.

4. Staying on Top of Cash Flow

Contractors who rely on spreadsheets or disconnected tools often lose track of who has paid and who hasn’t. That guesswork creates stress and uncertainty.

With connected invoicing tools, you get:

- Dashboards that show whether invoices are sent, opened, or overdue

- Automatic reminders that reduce the need for chasing

- Reports that highlight patterns in payments and spending

This kind of visibility lets contractors plan ahead instead of reacting at the last moment.

5. A Case from the Field

Day-View Electric, a mid-sized contractor in Ottawa, used to handle billing with spreadsheets and email. That meant delays, missed updates, and frequent back-and-forth with clients.

Switching to a digital invoicing system changed the game:

- Service capacity grew by 30% without extra admin hires

- Job costing time dropped by half

- Invoicing speed improved by four to six weeks

The result wasn’t just faster payments but also clearer control over the company’s finances.

6. What Contractors Look For

Conversations with tradespeople point to a few essentials:

- The ability to send invoices from the job site instead of waiting until later

- Automatic inclusion of hours worked, parts used, and job details

- Smooth integration with scheduling and customer records

Those features cut down on admin work and keep the billing process consistent from start to finish.

Final Thoughts

Contractors relying on paper forms or outdated methods often end up chasing payments. Those who use tools designed for their trade put themselves in a position to get paid faster, avoid disputes, and focus on the work itself.

Billing technology is no longer just a convenience. For many, it’s become the difference between cash flow that stalls and cash flow that supports growth.

;